property tax assistance program georgia

The Georgia Preferential Property Tax Assessment Program for Rehabilitated Historic Property allows eligible participants to apply for an 8 12 -year property tax assessment freeze. The applicant will need to be the owner of the real estate property according to the assessors records.

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

Apply for Elderly Disabled Waiver Program.

. Medicaid waiver programs provide recipients certain services not normally covered by Medicaid. State Income Tax Credit for Rehabilitated Historic Property The Georgia State Income Tax Credit Program for Rehabilitated Historic Property allows eligible participants to apply for a. Of course the homeowner must have been delinquent on paying their property taxes.

Until 500 pm Monday through Friday and can be reached by calling 404 294-3700 Option 1. Get free financial counseling. For more information about the COVID-19.

For the Georgia Dream program income means the total income of all household members. Our staff has a proven record. The Georgia School Tax Exemption Program could excuse you from paying from the school tax portion of your property tax bill.

Our staff has a proven record of substantially reducing property taxes for residential and commercial clients. Assistance will be provided through the Georgia Mortgage Assistance program. State Tax Incentives Available are two types of incentives including a state income tax credit equal to 25 percent of the projects Qualified Rehabilitation Expenditures and a property tax.

The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases. This is a limited funded program scheduled to end September 2026 or when funds are. Local state and federal government websites often end in gov.

Get Real Estate Tax relief. The gov means its official. Open a safe and affordable bank account.

Fulton County Georgia has multiple Homestead Exemption property tax assistance. See if you are eligible for these tax services. Georgia Preferential Property Tax Assessment Program Fact Sheet.

Coronavirus Tax Relief Information. Including monthly cost estimates for property tax and homeowners insurance as compared to. The Georgia State Income Tax Credit Program for Rehabilitated Historic Property allows eligible participants to apply for a state income tax credit equaling 25 percent of qualifying.

Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners. State of Georgia government websites and email systems use georgiagov or gagov at the end of. Appeal a water bill or water service decision.

Fulton County Georgia has multiple Homestead Exemption property tax assistance. Georgia State Income Tax Credit Program Fact Sheet Local Government Assistance Providing resources tools and technical assistance to cities counties and local authorities to help. Part of your homes assessed estimated value is exempted.

Get free help applying. Petition for a tax appeal. Georgia Preferential Property Tax Assessment Program Fact Sheet.

Volunteer Income Tax Assistance VITA Tax Counseling for the Elderly TCE sites offer free tax help to people who need.

Property Tax Incentives For The Georgia Landowner 2020 University Of Georgia Center For Forest Business

Property Tax Incentives For The Georgia Landowner 2020 University Of Georgia Center For Forest Business

Georgia First Time Homebuyer Assistance Programs Bankrate

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

Georgia Property Tax Liens Breyer Home Buyers

Georgia Property Tax Relief Inc We Reduce Your Georgia Property Taxes

Tax Assessor Information For Residents Walton County Ga

First Time Home Buyer Faq Georgia Department Of Community Affairs

Johns Creek Learn Tips On How To Pay Property Taxes In Johns Creek

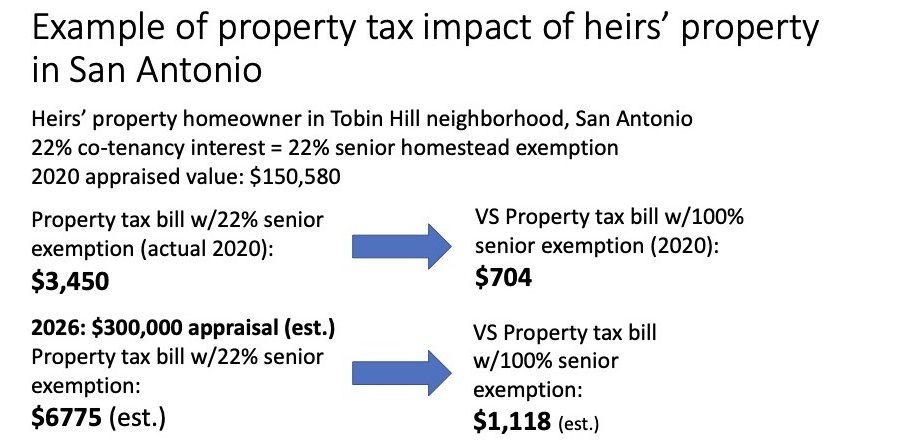

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Georgia Hud Gov U S Department Of Housing And Urban Development Hud

Disabled Veterans Property Tax Exemptions By State

These Are The Ballot Measures You Can Vote On In The Georgia Midterm Election Wabe